Page not found

Browse by Subject

Gideon's Latest Posts:

-

Thursday October 9th, 9:00am -

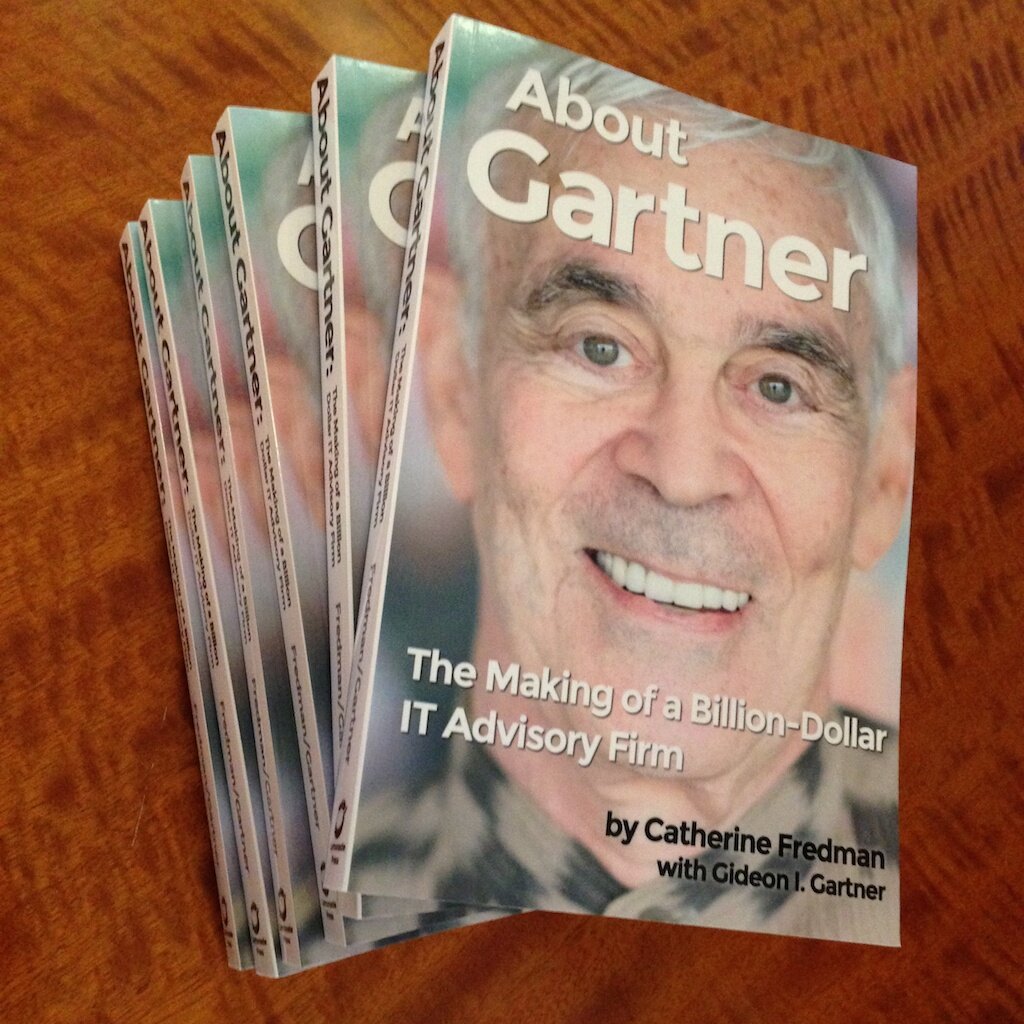

35th Anniversary of Gartner Inc.'s Founding: Gartner Inc. (originally called Gartner Group) was born on April 1, 1979, together with a ... [read more]

35th Anniversary of Gartner Inc.'s Founding: Gartner Inc. (originally called Gartner Group) was born on April 1, 1979, together with a ... [read more]

-

Saturday July 21st, 4:57pm -

Oh My Darling Clementine: My three year-old grand-daughter Clementine is very smart. While she's never taken any piano lessons ... [read more]

Oh My Darling Clementine: My three year-old grand-daughter Clementine is very smart. While she's never taken any piano lessons ... [read more]

-

Friday November 25th, 11:54am -

Social Networking May Be Bad for Your Health: What might have once been called 'intellectual networking' seems to have been displaced by today's ... [read more]

Social Networking May Be Bad for Your Health: What might have once been called 'intellectual networking' seems to have been displaced by today's ... [read more]

Future of America

-

(06/11/2011)

Genius Economist Suggests Solution to Housing Problem: John Geanakoplos is James Tobin professor of economics at Yale University and one of the founders of Ellington Capital Management, ... [read more]

Genius Economist Suggests Solution to Housing Problem: John Geanakoplos is James Tobin professor of economics at Yale University and one of the founders of Ellington Capital Management, ... [read more]

-

(06/09/2011)

Which Executive Education School Is Tops?: Interestingly, executive education rankings by various publications produce results which seem all over the map. In fact, the ... [read more]

Which Executive Education School Is Tops?: Interestingly, executive education rankings by various publications produce results which seem all over the map. In fact, the ... [read more]