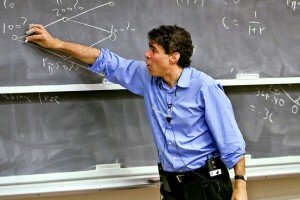

John Geanakoplos

John Geanakoplos is James Tobin professor of economics at Yale University and one of the founders of Ellington Capital Management, where he remains a partner. He was the invited guest speaker at the ‘Fund of Funds’ named ‘Alternative Investments’ which we subscribed to for many years, and are now re-investing, as we viewed its rigorous methods and excellent staff, resulting in relatively stable and acceptable returns during the current and difficult economic period.

Mr. Geanakoplos’ remarks focused on the housing crisis and potential solutions. He believes the government’s plan to stem the wave of foreclosures by reducing interest payments, not only wastes taxpayers’ money but also does not address the foreclosure problem! Instead, he proposes that banks and bondholders write down principal, far enough to give homeowners some (or more) equity in their homes, thus incentivizing them to start paying their mortgages again and avoid future defaults!

Despite job losses and our poor economy overall, almost all homeowners with real equity in their homes will find a way to pay off their loans. But in contrast, those who are “under water” on their mortgages typically default, not because they are irresponsible but because it is the economically prudent thing to do. He believes banks and bondholders, not taxpayers, should assume the cost of modifications, because most parties will be better off if mortgages are modified correctly and foreclosures stopped!

The biggest impediment to banks writing down principal is their expectation of another government bailout, one in which taxpayers effectively buy out their “under water” mortgages at or close to their original inflated values.

Mr. Geanakoplos’ logic was complex but convincing to most sophisticates in the audience.

106 Comments