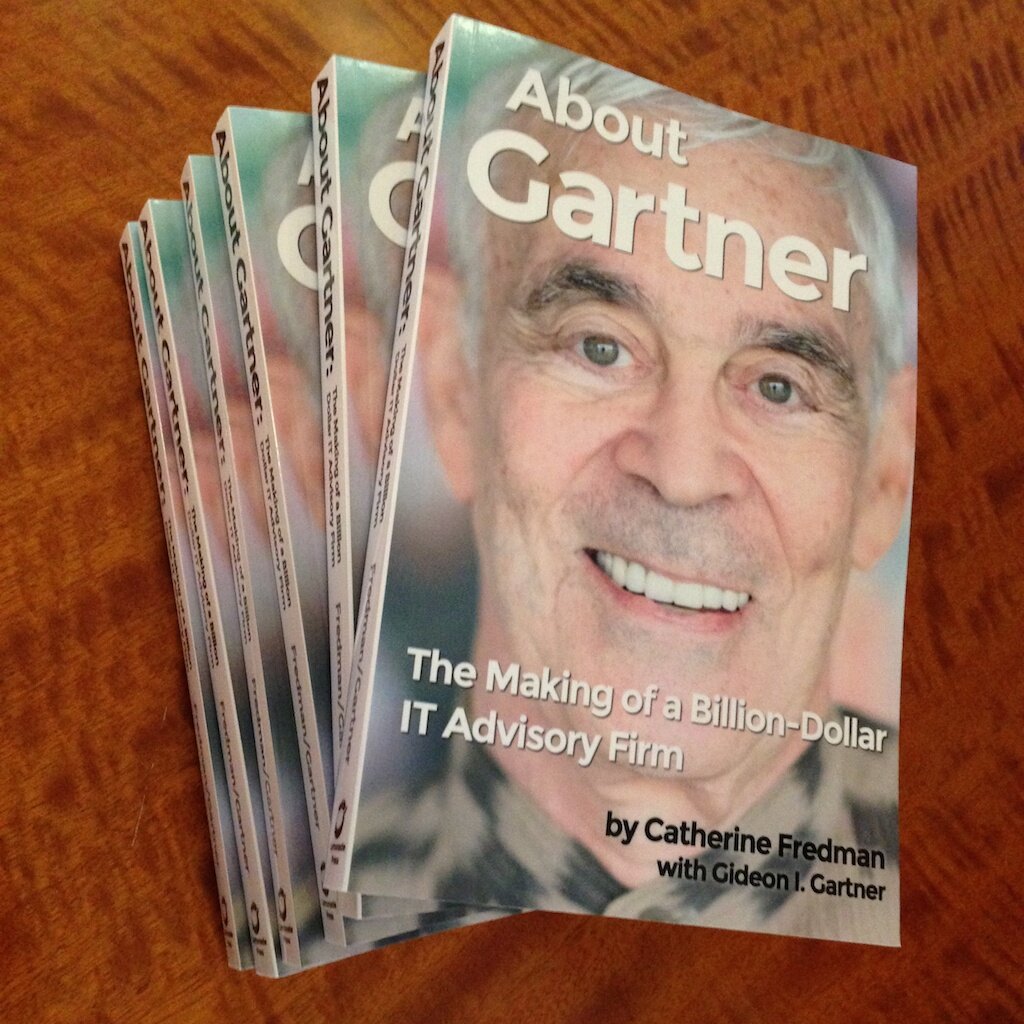

Gartner’s Original Research process

Part 1.

I was influenced during Gartner Group’s first year (March 1979-April 1980) by reading two public documents: the book “the Tao Jones Averages: A Guide to Whole-Brained Investing” by Bennet Goodspeed, and an article written by David B. Montgomery and Charles B. Weinberg ‘Toward Strategic Intelligence Systems’ (Journal of Marketing 43, Fall 1979). The first of these promoted the concept of “inferential analysis” which emphasized how evidence to support research conclusions was often abundantly available, and should be tapped. The second presented concepts which when tweaked somewhat, became fundamental to our internal research processes. These books prepared me to push three concepts: ‘survey’ (maximize the bandwidth of relevant information flow), ‘search’ (employ proactive research to follow-up on evidence), and ‘pattern recognition’ which is the talent which analysts should possess (or be asked to develop). I trusted that practice would lead to results, helping us to identify ‘patterns’ from the complex information mosaics which resulted from normal research activities.

I was influenced during Gartner Group’s first year (March 1979-April 1980) by reading two public documents: the book “the Tao Jones Averages: A Guide to Whole-Brained Investing” by Bennet Goodspeed, and an article written by David B. Montgomery and Charles B. Weinberg ‘Toward Strategic Intelligence Systems’ (Journal of Marketing 43, Fall 1979). The first of these promoted the concept of “inferential analysis” which emphasized how evidence to support research conclusions was often abundantly available, and should be tapped. The second presented concepts which when tweaked somewhat, became fundamental to our internal research processes. These books prepared me to push three concepts: ‘survey’ (maximize the bandwidth of relevant information flow), ‘search’ (employ proactive research to follow-up on evidence), and ‘pattern recognition’ which is the talent which analysts should possess (or be asked to develop). I trusted that practice would lead to results, helping us to identify ‘patterns’ from the complex information mosaics which resulted from normal research activities.

Admittedly, I frequently modified our documentation which formalized our firm’s research process, expanding from the three-part Strategic Intelligence Systems (SIS) to create our very own six-point system:

- Surveillance

- Pattern Recognition

- Stalking Horses

- Search

- Document

Scenarios and Strategic Planning Assumptions.

I explain each of these in more detail in Part 2 (my next post) however the overall system had its roots when during the 1970s I was a securities analyst at Wall Street’s E.F.Hutton and Oppenheimer&Co. (Opco) where I discovered that in information industries, formal structures were often critical in obtaining competitive advantage (see explanatory note at the end of this post). After leaving Oppenheimer to create the IT advisory firm called ‘Gartner Group’, the firm’s success was arguably based upon our unusual research methods. Simply put, some combination of processes whichwould be taken seriously by first our own analysts and subsequently by our client prospects.

Like Rome, I could not build our system in a day, in fact it took a period of over two years! I finally authored a detailed document called “The Gartner Group Research Notebook”; and every few months I would gather our new analysts and teach them a course based upon this compilation of our special research methods (eventually our research leaders took over the teaching). The very existence of this manual lent credibility to our new methods.

Our Gartner company grew from offering the market one service covering the entire IT space, to almost a dozen, while our sales force grew in size while impacting multiple constituencies: Wall Street clients, technology vendors, and corporate users of technology, each with different (but overlapping) advice requirements). We also sold to governments, initiated a consulting practice, and continuously redesigned and expanded our quite innovative conference offerings , all this while expanding into new geographies.

I was not always easy to deal with, insisting that our analyst corps embrace not only our research process, but authoring principles as well (timeliness, relevance, meaningful and actionable conclusions, clarity, brevity where possible, and even decent grammar (helped by our editors)! We were essentially embracing “added-value” versus “reporting”. The bottom line: Gartner’s overall process led many clients to value our research methods, depth, and conclusions.

Note: I had been hired by Wall Street despite my limited financial background because I knew the IT landscape cold from working in IBM’s competitive analysis department, so at Hutton and Opco I had to compensate for my weak financial capabilities. Whatever I did resulted in obtaining a leg up on my competition, not just in terms of knowledge but in designing our original combination of research and delivery methods.

10 Comments